Page 205 - Pakistan Oilfields Limited - Annual Report 2021

P. 205

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

8.1 The Group has set aside an insurance reserve for self insurance of assets which have not been insured

and for deductibles against insurance claims.

8.2 This includes Rs 1,557,794 (2020: Rs 1,557,941) set aside by POL on account of gain on sale of

investments as investment reserve to meet any future losses/ impairment on investments.

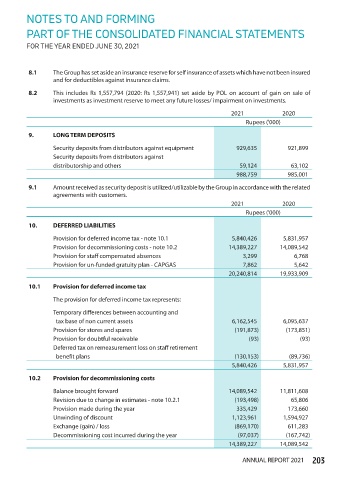

2021 2020

Rupees ('000)

9. LONG TERM DEPOSITS

Security deposits from distributors against equipment 929,635 921,899

Security deposits from distributors against

distributorship and others 59,124 63,102

988,759 985,001

9.1 Amount received as security deposit is utilized/utilizable by the Group in accordance with the related

agreements with customers.

2021 2020

Rupees ('000)

10. DEFERRED LIABILITIES

Provision for deferred income tax - note 10.1 5,840,426 5,831,957

Provision for decommissioning costs - note 10.2 14,389,227 14,089,542

Provision for staff compensated absences 3,299 6,768

Provision for un-funded gratuity plan - CAPGAS 7,862 5,642

20,240,814 19,933,909

10.1 Provision for deferred income tax

The provision for deferred income tax represents:

Temporary differences between accounting and

tax base of non current assets 6,162,545 6,095,637

Provision for stores and spares (191,873) (173,851)

Provision for doubtful receivable (93) (93)

Deferred tax on remeasurement loss on staff retirement

benefit plans (130,153) (89,736)

5,840,426 5,831,957

10.2 Provision for decommissioning costs

Balance brought forward 14,089,542 11,811,608

Revision due to change in estimates - note 10.2.1 (193,498) 65,806

Provision made during the year 335,429 173,660

Unwinding of discount 1,123,961 1,594,927

Exchange (gain) / loss (869,170) 611,283

Decommissioning cost incurred during the year (97,037) (167,742)

14,389,227 14,089,542

ANNUAL REPORT 2021 203