Page 203 - Pakistan Oilfields Limited - Annual Report 2021

P. 203

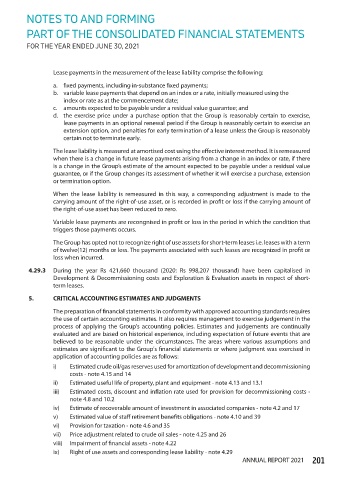

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

Lease payments in the measurement of the lease liability comprise the following:

a. fixed payments, including in-substance fixed payments;

b. variable lease payments that depend on an index or a rate, initially measured using the

index or rate as at the commencement date;

c. amounts expected to be payable under a residual value guarantee; and

d. the exercise price under a purchase option that the Group is reasonably certain to exercise,

lease payments in an optional renewal period if the Group is reasonably certain to exercise an

extension option, and penalties for early termination of a lease unless the Group is reasonably

certain not to terminate early.

The lease liability is measured at amortised cost using the effective interest method. It is remeasured

when there is a change in future lease payments arising from a change in an index or rate, if there

is a change in the Group’s estimate of the amount expected to be payable under a residual value

guarantee, or if the Group changes its assessment of whether it will exercise a purchase, extension

or termination option.

When the lease liability is remeasured in this way, a corresponding adjustment is made to the

carrying amount of the right-of-use asset, or is recorded in profit or loss if the carrying amount of

the right-of-use asset has been reduced to zero.

Variable lease payments are recongnised in profit or loss in the period in which the condition that

triggers those payments occurs.

The Group has opted not to recognize right of use asssets for short-term leases i.e. leases with a term

of twelve(12) months or less. The payments associated with such leases are recognized in profit or

loss when incurred.

4.29.3 During the year Rs 421,660 thousand (2020: Rs 998,207 thousand) have been capitalised in

Development & Decommissioning costs and Exploration & Evaluation assets in respect of short-

term leases.

5. CRITICAL ACCOUNTING ESTIMATES AND JUDGMENTS

The preparation of financial statements in conformity with approved accounting standards requires

the use of certain accounting estimates. It also requires management to exercise judgement in the

process of applying the Group's accounting policies. Estimates and judgements are continually

evaluated and are based on historical experience, including expectation of future events that are

believed to be reasonable under the circumstances. The areas where various assumptions and

estimates are significant to the Group's financial statements or where judgment was exercised in

application of accounting policies are as follows:

i) Estimated crude oil/gas reserves used for amortization of development and decommissioning

costs - note 4.15 and 14

ii) Estimated useful life of property, plant and equipment - note 4.13 and 13.1

iii) Estimated costs, discount and inflation rate used for provision for decommissioning costs -

note 4.8 and 10.2

iv) Estimate of recoverable amount of investment in associated companies - note 4.2 and 17

v) Estimated value of staff retirement benefits obligations - note 4.10 and 39

vi) Provision for taxation - note 4.6 and 35

vii) Price adjustment related to crude oil sales - note 4.25 and 26

viii) Impairment of financial assets - note 4.22

ix) Right of use assets and corresponding lease liability - note 4.29

ANNUAL REPORT 2021 201