Page 230 - Pakistan Oilfields Limited - Annual Report 2021

P. 230

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rating Rupees ('000)

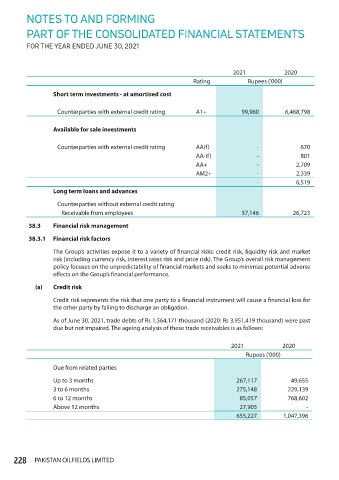

Short term investments - at amortised cost

Counterparties with external credit rating A1+ 99,960 6,468,798

Available for sale investments

Counterparties with external credit rating AA(f) - 670

AA-(f) - 801

AA+ - 2,709

AM2+ - 2,339

- 6,519

Long term loans and advances

Counterparties without external credit rating

Receivable from employees 37,146 26,723

38.3 Financial risk management

38.3.1 Financial risk factors

The Group’s activities expose it to a variety of financial risks: credit risk, liquidity risk and market

risk (including currency risk, interest rates risk and price risk). The Group’s overall risk management

policy focuses on the unpredictability of financial markets and seeks to minimize potential adverse

effects on the Group’s financial performance.

(a) Credit risk

Credit risk represents the risk that one party to a financial instrument will cause a financial loss for

the other party by failing to discharge an obligation.

As of June 30, 2021, trade debts of Rs 1,564,171 thousand (2020: Rs 3,951,419 thousand) were past

due but not impaired. The ageing analysis of these trade receivables is as follows:

2021 2020

Rupees ('000)

Due from related parties

Up to 3 months 267,117 49,655

3 to 6 months 275,148 229,139

6 to 12 months 85,057 768,602

Above 12 months 27,905 -

655,227 1,047,396

228 PAKISTAN OILFIELDS LIMITED