Page 176 - Pakistan Oilfield Limited - Annual Report 2022

P. 176

174 175

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the

Financial Statements

For the year ended June 30, 2022

2022 2021

Rupees ('000)

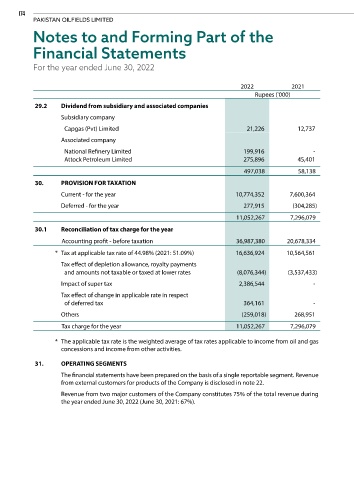

29.2 Dividend from subsidiary and associated companies

Subsidiary company

Capgas (Pvt) Limited 21,226 12,737

Associated company

National Refinery Limited 199,916 -

Attock Petroleum Limited 275,896 45,401

497,038 58,138

30. PROVISION FOR TAXATION

Current - for the year 10,774,352 7,600,364

Deferred - for the year 277,915 (304,285)

11,052,267 7,296,079

30.1 Reconciliation of tax charge for the year

Accounting profit - before taxation 36,987,380 20,678,334

* Tax at applicable tax rate of 44.98% (2021: 51.09%) 16,636,924 10,564,561

Tax effect of depletion allowance, royalty payments

and amounts not taxable or taxed at lower rates (8,076,344) (3,537,433)

Impact of super tax 2,386,544 -

Tax effect of change in applicable rate in respect

of deferred tax 364,161 -

Others (259,018) 268,951

Tax charge for the year 11,052,267 7,296,079

* The applicable tax rate is the weighted average of tax rates applicable to income from oil and gas

concessions and income from other activities.

31. OPERATING SEGMENTS

The financial statements have been prepared on the basis of a single reportable segment. Revenue

from external customers for products of the Company is disclosed in note 22.

Revenue from two major customers of the Company constitutes 75% of the total revenue during

the year ended June 30, 2022 (June 30, 2021: 67%).