Page 181 - Pakistan Oilfield Limited - Annual Report 2022

P. 181

178 179

Annual Report 2022

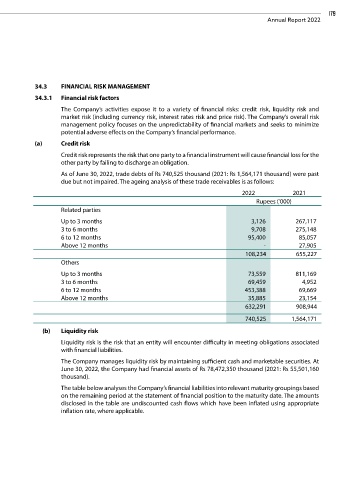

34.3 FINANCIAL RISK MANAGEMENT

34.3.1 Financial risk factors

The Company’s activities expose it to a variety of financial risks: credit risk, liquidity risk and

market risk (including currency risk, interest rates risk and price risk). The Company’s overall risk

management policy focuses on the unpredictability of financial markets and seeks to minimize

potential adverse effects on the Company’s financial performance.

(a) Credit risk

Credit risk represents the risk that one party to a financial instrument will cause financial loss for the

other party by failing to discharge an obligation.

As of June 30, 2022, trade debts of Rs 740,525 thousand (2021: Rs 1,564,171 thousand) were past

due but not impaired. The ageing analysis of these trade receivables is as follows:

2022 2021

Rupees ('000)

Related parties

Up to 3 months 3,126 267,117

3 to 6 months 9,708 275,148

6 to 12 months 95,400 85,057

Above 12 months - 27,905

108,234 655,227

Others

Up to 3 months 73,559 811,169

3 to 6 months 69,459 4,952

6 to 12 months 453,388 69,669

Above 12 months 35,885 23,154

632,291 908,944

740,525 1,564,171

(b) Liquidity risk

Liquidity risk is the risk that an entity will encounter difficulty in meeting obligations associated

with financial liabilities.

The Company manages liquidity risk by maintaining sufficient cash and marketable securities. At

June 30, 2022, the Company had financial assets of Rs 78,472,350 thousand (2021: Rs 55,501,160

thousand).

The table below analyses the Company’s financial liabilities into relevant maturity groupings based

on the remaining period at the statement of financial position to the maturity date. The amounts

disclosed in the table are undiscounted cash flows which have been inflated using appropriate

inflation rate, where applicable.