Page 177 - Pakistan Oilfield Limited - Annual Report 2022

P. 177

174 175

Annual Report 2022

2022 2021

Rupees ('000)

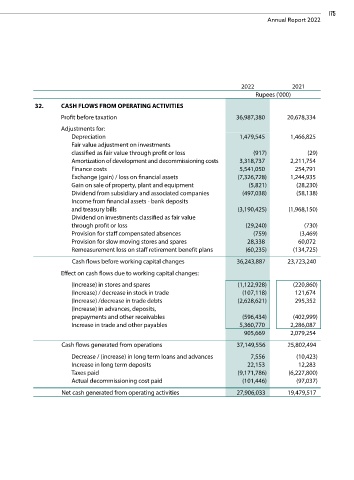

32. CASH FLOWS FROM OPERATING ACTIVITIES

Profit before taxation 36,987,380 20,678,334

Adjustments for:

Depreciation 1,479,545 1,466,825

Fair value adjustment on investments

classified as fair value through profit or loss (917) (29)

Amortization of development and decommissioning costs 3,318,737 2,211,754

Finance costs 5,541,050 254,791

Exchange (gain) / loss on financial assets (7,326,728) 1,244,935

Gain on sale of property, plant and equipment (5,821) (28,230)

Dividend from subsidiary and associated companies (497,038) (58,138)

Income from financial assets - bank deposits

and treasury bills (3,190,425) (1,968,150)

Dividend on investments classified as fair value

through profit or loss (29,240) (730)

Provision for staff compensated absences (759) (3,469)

Provision for slow moving stores and spares 28,338 60,072

Remeasurement loss on staff retirement benefit plans (60,235) (134,725)

Cash flows before working capital changes 36,243,887 23,723,240

Effect on cash flows due to working capital changes:

(Increase) in stores and spares (1,122,928) (220,860)

(Increase) / decrease in stock in trade (107,118) 121,674

(Increase) /decrease in trade debts (2,628,621) 295,352

(Increase) in advances, deposits,

prepayments and other receivables (596,434) (402,999)

Increase in trade and other payables 5,360,770 2,286,087

905,669 2,079,254

Cash flows generated from operations 37,149,556 25,802,494

Decrease / (increase) in long term loans and advances 7,556 (10,423)

Increase in long term deposits 22,153 12,283

Taxes paid (9,171,786) (6,227,800)

Actual decommissioning cost paid (101,446) (97,037)

Net cash generated from operating activities 27,906,033 19,479,517