Page 180 - Pakistan Oilfield Limited - Annual Report 2022

P. 180

178 179

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the

Financial Statements

For the year ended June 30, 2022

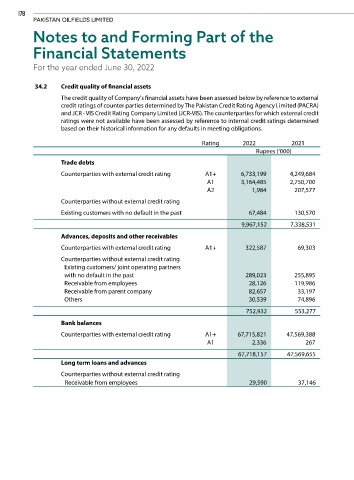

34.2 Credit quality of financial assets

The credit quality of Company's financial assets have been assessed below by reference to external

credit ratings of counter parties determined by The Pakistan Credit Rating Agency Limited (PACRA)

and JCR - VIS Credit Rating Company Limited (JCR-VIS). The counterparties for which external credit

ratings were not available have been assessed by reference to internal credit ratings determined

based on their historical information for any defaults in meeting obligations.

Rating 2022 2021

Rupees (‘000)

Trade debts

Counterparties with external credit rating A1+ 6,733,199 4,249,684

A1 3,164,485 2,750,700

A2 1,984 207,577

Counterparties without external credit rating

Existing customers with no default in the past 67,484 130,570

9,967,152 7,338,531

Advances, deposits and other receivables

Counterparties with external credit rating A1+ 322,587 69,303

Counterparties without external credit rating

Existing customers/ joint operating partners

with no default in the past 289,023 255,895

Receivable from employees 28,126 119,986

Receivable from parent company 82,657 33,197

Others 30,539 74,896

752,932 553,277

Bank balances

Counterparties with external credit rating A1+ 67,715,821 47,569,388

A1 2,336 267

67,718,157 47,569,655

Long term loans and advances

Counterparties without external credit rating

Receivable from employees 29,590 37,146