Page 186 - Pakistan Oilfield Limited - Annual Report 2022

P. 186

184 185

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the

Financial Statements

For the year ended June 30, 2022

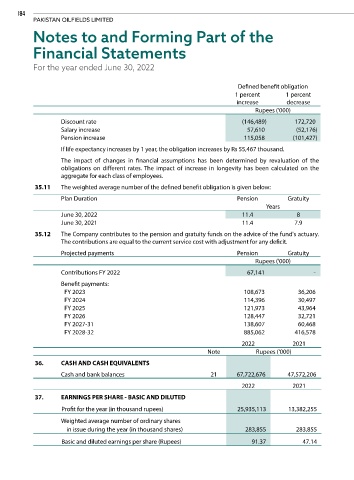

Defined benefit obligation

1 percent 1 percent

increase decrease

Rupees ('000)

Discount rate (146,489) 172,720

Salary increase 57,610 (52,176)

Pension increase 115,058 (101,427)

If life expectancy increases by 1 year, the obligation increases by Rs 55,467 thousand.

The impact of changes in financial assumptions has been determined by revaluation of the

obligations on different rates. The impact of increase in longevity has been calculated on the

aggregate for each class of employees.

35.11 The weighted average number of the defined benefit obligation is given below:

Plan Duration Pension Gratuity

Years

June 30, 2022 11.4 8

June 30, 2021 11.4 7.9

35.12 The Company contributes to the pension and gratuity funds on the advice of the fund's actuary.

The contributions are equal to the current service cost with adjustment for any deficit.

Projected payments Pension Gratuity

Rupees ('000)

Contributions FY 2022 67,141 -

Benefit payments:

FY 2023 108,673 36,206

FY 2024 114,396 30,497

FY 2025 121,973 43,964

FY 2026 128,447 32,721

FY 2027-31 138,607 60,468

FY 2028-32 885,062 416,578

2022 2021

Note Rupees ('000)

36. CASH AND CASH EQUIVALENTS

Cash and bank balances 21 67,722,676 47,572,206

2022 2021

37. EARNINGS PER SHARE - BASIC AND DILUTED

Profit for the year (in thousand rupees) 25,935,113 13,382,255

Weighted average number of ordinary shares

in issue during the year (in thousand shares) 283,855 283,855

Basic and diluted earnings per share (Rupees) 91.37 47.14