Page 182 - Pakistan Oilfield Limited - Annual Report 2022

P. 182

180 181

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the

Financial Statements

For the year ended June 30, 2022

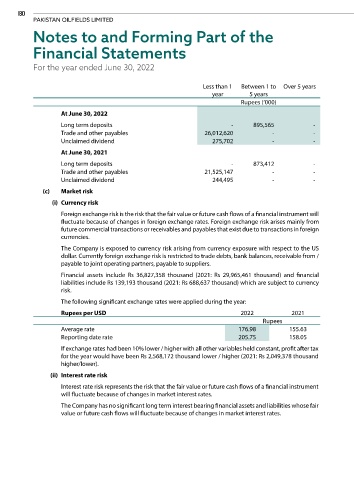

Less than 1 Between 1 to Over 5 years

year 5 years

Rupees (‘000)

At June 30, 2022

Long term deposits - 895,565 -

Trade and other payables 26,012,620 - -

Unclaimed dividend 275,702 - -

At June 30, 2021

Long term deposits - 873,412 -

Trade and other payables 21,525,147 - -

Unclaimed dividend 244,495 - -

(c) Market risk

(i) Currency risk

Foreign exchange risk is the risk that the fair value or future cash flows of a financial instrument will

fluctuate because of changes in foreign exchange rates. Foreign exchange risk arises mainly from

future commercial transactions or receivables and payables that exist due to transactions in foreign

currencies.

The Company is exposed to currency risk arising from currency exposure with respect to the US

dollar. Currently foreign exchange risk is restricted to trade debts, bank balances, receivable from /

payable to joint operating partners, payable to suppliers.

Financial assets include Rs 36,827,358 thousand (2021: Rs 29,965,461 thousand) and financial

liabilities include Rs 139,193 thousand (2021: Rs 688,637 thousand) which are subject to currency

risk.

The following significant exchange rates were applied during the year:

Rupees per USD 2022 2021

Rupees

Average rate 176.98 155.63

Reporting date rate 205.75 158.05

If exchange rates had been 10% lower / higher with all other variables held constant, profit after tax

for the year would have been Rs 2,568,172 thousand lower / higher (2021: Rs 2,049,378 thousand

higher/lower).

(ii) Interest rate risk

Interest rate risk represents the risk that the fair value or future cash flows of a financial instrument

will fluctuate because of changes in market interest rates.

The Company has no significant long term interest bearing financial assets and liabilities whose fair

value or future cash flows will fluctuate because of changes in market interest rates.