Page 184 - Pakistan Oilfield Limited - Annual Report 2022

P. 184

182 183

PAKISTAN OILFIELDS LIMITED

Notes to and Forming Part of the

Financial Statements

For the year ended June 30, 2022

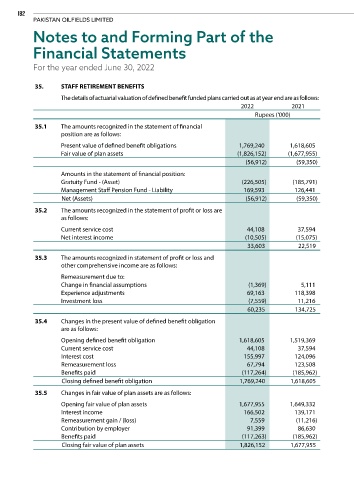

35. STAFF RETIREMENT BENEFITS

The details of actuarial valuation of defined benefit funded plans carried out as at year end are as follows:

2022 2021

Rupees ('000)

35.1 The amounts recognized in the statement of financial

position are as follows:

Present value of defined benefit obligations 1,769,240 1,618,605

Fair value of plan assets (1,826,152) (1,677,955)

(56,912) (59,350)

Amounts in the statement of financial position:

Gratuity Fund - (Asset) (226,505) (185,791)

Management Staff Pension Fund - Liability 169,593 126,441

Net (Assets) (56,912) (59,350)

35.2 The amounts recognized in the statement of profit or loss are

as follows:

Current service cost 44,108 37,594

Net interest income (10,505) (15,075)

33,603 22,519

35.3 The amounts recognized in statement of profit or loss and

other comprehensive income are as follows:

Remeasurement due to:

Change in financial assumptions (1,369) 5,111

Experience adjustments 69,163 118,398

Investment loss (7,559) 11,216

60,235 134,725

35.4 Changes in the present value of defined benefit obligation

are as follows:

Opening defined benefit obligation 1,618,605 1,519,369

Current service cost 44,108 37,594

Interest cost 155,997 124,096

Remeasurement loss 67,794 123,508

Benefits paid (117,264) (185,962)

Closing defined benefit obligation 1,769,240 1,618,605

35.5 Changes in fair value of plan assets are as follows:

Opening fair value of plan assets 1,677,955 1,649,332

Interest income 166,502 139,171

Remeasurement gain / (loss) 7,559 (11,216)

Contribution by employer 91,399 86,630

Benefits paid (117,263) (185,962)

Closing fair value of plan assets 1,826,152 1,677,955