Page 19 - Condensed Interim Financial Statements - for the nine months ended March 31, 2024

P. 19

Notes to and forming part of the Condensed Interim

Financial Statements (Unaudited)

For the nine months ended March 31, 2024

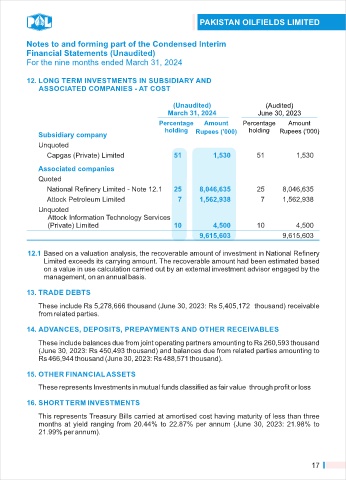

12. LONG TERM INVESTMENTS IN SUBSIDIARY AND

ASSOCIATED COMPANIES - AT COST

(Unaudited) (Audited)

March 31, 2024 June 30, 2023

Percentage Amount Percentage Amount

holding Rupees ('000) holding Rupees ('000)

Subsidiary company

Unquoted

Capgas (Private) Limited 51 1,530 51 1,530

Associated companies

Quoted

National Refinery Limited - Note 12.1 25 8,046,635 25 8,046,635

Attock Petroleum Limited 7 1,562,938 7 1,562,938

Unquoted

Attock Information Technology Services

(Private) Limited 10 4,500 10 4,500

9,615,603 9,615,603

12.1 Based on a valuation analysis, the recoverable amount of investment in National Refinery

Limited exceeds its carrying amount. The recoverable amount had been estimated based

on a value in use calculation carried out by an external investment advisor engaged by the

management, on an annual basis.

13. TRADE DEBTS

These include Rs 5,278,666 thousand (June 30, 2023: Rs 5,405,172 thousand) receivable

from related parties.

14. ADVANCES, DEPOSITS, PREPAYMENTS AND OTHER RECEIVABLES

These include balances due from joint operating partners amounting to Rs 260,593 thousand

(June 30, 2023: Rs 450,493 thousand) and balances due from related parties amounting to

Rs 466,944 thousand (June 30, 2023: Rs 488,571 thousand).

15. OTHER FINANCIAL ASSETS

These represents Investments in mutual funds classified as fair value through profit or loss

16. SHORT TERM INVESTMENTS

This represents Treasury Bills carried at amortised cost having maturity of less than three

months at yield ranging from 20.44% to 22.87% per annum (June 30, 2023: 21.98% to

21.99% per annum).

17