Page 33 - Condensed Interim Financial Statements - For Nine Months Ended March 31, 2022

P. 33

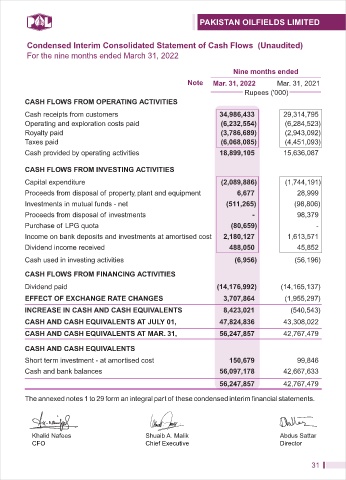

Condensed Interim Consolidated Statement of Cash Flows (Unaudited)

For the nine months ended March 31, 2022

Nine months ended

Note Mar. 31, 2022 Mar. 31, 2021

Rupees ('000)

CASH FLOWS FROM OPERATING ACTIVITIES

Cash receipts from customers 34,986,433 29,314,795

Operating and exploration costs paid (6,232,554) (6,284,523)

Royalty paid (3,786,689) (2,943,092)

Taxes paid (6,068,085) (4,451,093)

Cash provided by operating activities 18,899,105 15,636,087

CASH FLOWS FROM INVESTING ACTIVITIES

Capital expenditure (2,089,886) (1,744,191)

Proceeds from disposal of property, plant and equipment 6,677 28,999

Investments in mutual funds - net (511,265) (98,806)

Proceeds from disposal of investments - 98,379

Purchase of LPG quota (80,659) -

Income on bank deposits and investments at amortised cost 2,180,127 1,613,571

Dividend income received 488,050 45,852

Cash used in investing activities (6,956) (56,196)

CASH FLOWS FROM FINANCING ACTIVITIES

Dividend paid (14,176,992) (14,165,137)

EFFECT OF EXCHANGE RATE CHANGES 3,707,864 (1,955,297)

INCREASE IN CASH AND CASH EQUIVALENTS 8,423,021 (540,543)

CASH AND CASH EQUIVALENTS AT JULY 01, 47,824,836 43,308,022

CASH AND CASH EQUIVALENTS AT MAR. 31, 56,247,857 42,767,479

CASH AND CASH EQUIVALENTS

Short term investment - at amortised cost 150,679 99,846

Cash and bank balances 56,097,178 42,667,633

56,247,857 42,767,479

The annexed notes 1 to 29 form an integral part of these condensed interim financial statements.

Khalid Nafees Shuaib A. Malik Abdus Sattar

CFO Chief Executive Director

31