Page 35 - Condensed Interim Financial Statements - For Nine Months Ended March 31, 2022

P. 35

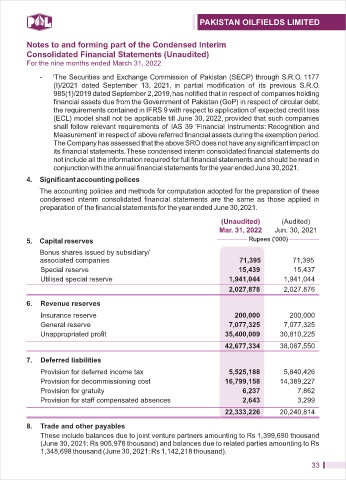

Notes to and forming part of the Condensed Interim

Consolidated Financial Statements (Unaudited)

For the nine months ended March 31, 2022

- 'The Securities and Exchange Commission of Pakistan (SECP) through S.R.O. 1177

(I)/2021 dated September 13, 2021, in partial modification of its previous S.R.O.

985(1)/2019 dated September 2, 2019, has notified that in respect of companies holding

financial assets due from the Government of Pakistan (GoP) in respect of circular debt,

the requirements contained in IFRS 9 with respect to application of expected credit loss

(ECL) model shall not be applicable till June 30, 2022, provided that such companies

shall follow relevant requirements of IAS 39 'Financial Instruments: Recognition and

Measurement' in respect of above referred financial assets during the exemption period.

The Company has assessed that the above SRO does not have any significant impact on

its financial statements. These condensed interim consolidated financial statements do

not include all the information required for full financial statements and should be read in

conjunction with the annual financial statements for the year ended June 30, 2021.

4. Significant accounting polices

The accounting policies and methods for computation adopted for the preparation of these

condensed interim consolidated financial statements are the same as those applied in

preparation of the financial statements for the year ended June 30, 2021.

(Unaudited) (Audited)

Mar. 31, 2022 Jun. 30, 2021

5. Capital reserves Rupees ('000)

Bonus shares issued by subsidiary/

associated companies 71,395 71,395

Special reserve 15,439 15,437

Utilised special reserve 1,941,044 1,941,044

2,027,878 2,027,876

6. Revenue reserves

Insurance reserve 200,000 200,000

General reserve 7,077,325 7,077,325

Unappropriated profit 35,400,009 30,810,225

42,677,334 38,087,550

7. Deferred liabilities

Provision for deferred income tax 5,525,188 5,840,426

Provision for decommissioning cost 16,799,158 14,389,227

Provision for gratuity 6,237 7,862

Provision for staff compensated absences 2,643 3,299

22,333,226 20,240,814

8. Trade and other payables

These include balances due to joint venture partners amounting to Rs 1,399,690 thousand

(June 30, 2021: Rs 905,978 thousand) and balances due to related parties amounting to Rs

1,348,698 thousand (June 30, 2021: Rs 1,142,218 thousand).

33