Page 165 - Pakistan Oilfields Limited - Annual Report 2021

P. 165

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

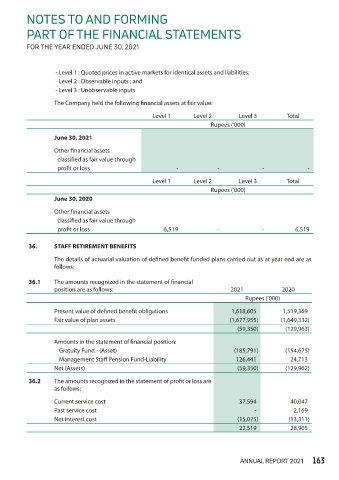

- Level 1 : Quoted prices in active markets for identical assets and liabilities;

- Level 2 : Observable inputs ; and

- Level 3 : Unobservable inputs

The Company held the following financial assets at fair value:

Level 1 Level 2 Level 3 Total

Rupees ('000)

June 30, 2021

Other financial assets

classified as fair value through

profit or loss - - - -

Level 1 Level 2 Level 3 Total

Rupees ('000)

June 30, 2020

Other financial assets

classified as fair value through

profit or loss 6,519 - - 6,519

36. STAFF RETIREMENT BENEFITS

The details of actuarial valuation of defined benefit funded plans carried out as at year end are as

follows:

36.1 The amounts recognized in the statement of financial

position are as follows: 2021 2020

Rupees ('000)

Present value of defined benefit obligations 1,618,605 1,519,369

Fair value of plan assets (1,677,955) (1,649,332)

(59,350) (129,963)

Amounts in the statement of financial position:

Gratuity Fund - (Asset) (185,791) (154,675)

Management Staff Pension Fund-Liability 126,441 24,713

Net (Assets) (59,350) (129,962)

36.2 The amounts recognized in the statement of profit or loss are

as follows:

Current service cost 37,594 40,047

Past service cost - 2,169

Net interest cost (15,075) (13,311)

22,519 28,905

ANNUAL REPORT 2021 163