Page 166 - Pakistan Oilfields Limited - Annual Report 2021

P. 166

NOTES TO AND FORMING

PART OF THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rupees ('000)

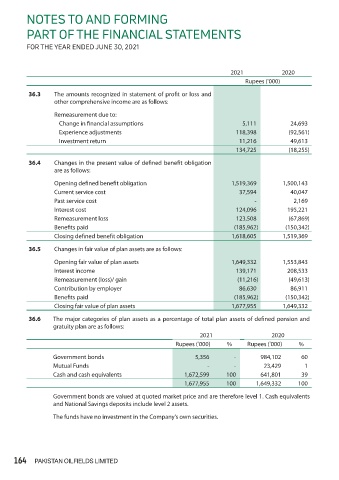

36.3 The amounts recognized in statement of profit or loss and

other comprehensive income are as follows:

Remeasurement due to:

Change in financial assumptions 5,111 24,693

Experience adjustments 118,398 (92,561)

Investment return 11,216 49,613

134,725 (18,255)

36.4 Changes in the present value of defined benefit obligation

are as follows:

Opening defined benefit obligation 1,519,369 1,500,143

Current service cost 37,594 40,047

Past service cost - 2,169

Interest cost 124,096 195,221

Remeasurement loss 123,508 (67,869)

Benefits paid (185,962) (150,342)

Closing defined benefit obligation 1,618,605 1,519,369

36.5 Changes in fair value of plan assets are as follows:

Opening fair value of plan assets 1,649,332 1,553,843

Interest income 139,171 208,533

Remeasurement (loss)/ gain (11,216) (49,613)

Contribution by employer 86,630 86,911

Benefits paid (185,962) (150,342)

Closing fair value of plan assets 1,677,955 1,649,332

36.6 The major categories of plan assets as a percentage of total plan assets of defined pension and

gratuity plan are as follows:

2021 2020

Rupees ('000) % Rupees ('000) %

Government bonds 5,356 - 984,102 60

Mutual Funds - - 23,429 1

Cash and cash equivalents 1,672,599 100 641,801 39

1,677,955 100 1,649,332 100

Government bonds are valued at quoted market price and are therefore level 1. Cash equivalents

and National Savings deposits include level 2 assets.

The funds have no investment in the Company’s own securities.

164 PAKISTAN OILFIELDS LIMITED