Page 207 - Pakistan Oilfields Limited - Annual Report 2021

P. 207

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

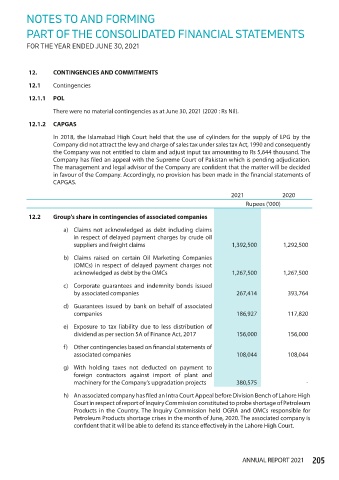

12. CONTINGENCIES AND COMMITMENTS

12.1 Contingencies

12.1.1 POL

There were no material contingencies as at June 30, 2021 (2020 : Rs Nil).

12.1.2 CAPGAS

In 2018, the Islamabad High Court held that the use of cylinders for the supply of LPG by the

Company did not attract the levy and charge of sales tax under sales tax Act, 1990 and consequently

the Company was not entitled to claim and adjust input tax amounting to Rs 5,644 thousand. The

Company has filed an appeal with the Supreme Court of Pakistan which is pending adjudication.

The management and legal advisor of the Company are confident that the matter will be decided

in favour of the Company. Accordingly, no provision has been made in the financial statements of

CAPGAS.

2021 2020

Rupees ('000)

12.2 Group's share in contingencies of associated companies

a) Claims not acknowledged as debt including claims

in respect of delayed payment charges by crude oil

suppliers and freight claims 1,392,500 1,292,500

b) Claims raised on certain Oil Marketing Companies

(OMCs) in respect of delayed payment charges not

acknowledged as debt by the OMCs 1,267,500 1,267,500

c) Corporate guarantees and indemnity bonds issued

by associated companies 267,414 393,764

d) Guarantees issued by bank on behalf of associated

companies 186,927 117,820

e) Exposure to tax liability due to less distribution of

dividend as per section 5A of Finance Act, 2017 156,000 156,000

f) Other contingencies based on financial statements of

associated companies 108,044 108,044

g) With holding taxes not deducted on payment to

foreign contractors against import of plant and

machinery for the Company’s upgradation projects 380,575 -

h) An associated company has filed an Intra Court Appeal before Division Bench of Lahore High

Court in respect of report of Inquiry Commission constituted to probe shortage of Petroleum

Products in the Country. The Inquiry Commission held OGRA and OMCs responsible for

Petroleum Products shortage crises in the month of June, 2020. The associated company is

confident that it will be able to defend its stance effectively in the Lahore High Court.

ANNUAL REPORT 2021 205