Page 214 - Pakistan Oilfields Limited - Annual Report 2021

P. 214

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rupees ('000)

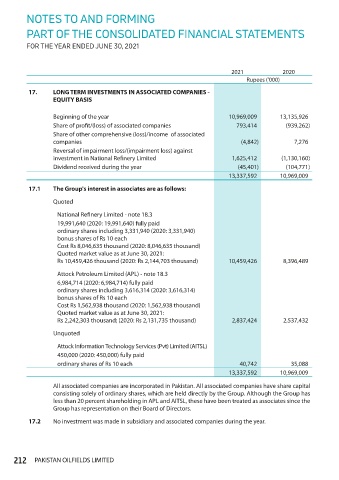

17. LONG TERM INVESTMENTS IN ASSOCIATED COMPANIES -

EQUITY BASIS

Beginning of the year 10,969,009 13,135,926

Share of profit/(loss) of associated companies 793,414 (939,262)

Share of other comprehensive (loss)/income of associated

companies (4,842) 7,276

Reversal of impairment loss/(impairment loss) against

investment in National Refinery Limited 1,625,412 (1,130,160)

Dividend received during the year (45,401) (104,771)

13,337,592 10,969,009

17.1 The Group's interest in associates are as follows:

Quoted

National Refinery Limited - note 18.3

19,991,640 (2020: 19,991,640) fully paid

ordinary shares including 3,331,940 (2020: 3,331,940)

bonus shares of Rs 10 each

Cost Rs 8,046,635 thousand (2020: 8,046,635 thousand)

Quoted market value as at June 30, 2021:

Rs 10,459,426 thousand (2020: Rs 2,144,703 thousand) 10,459,426 8,396,489

Attock Petroleum Limited (APL) - note 18.3

6,984,714 (2020: 6,984,714) fully paid

ordinary shares including 3,616,314 (2020: 3,616,314)

bonus shares of Rs 10 each

Cost Rs 1,562,938 thousand (2020: 1,562,938 thousand)

Quoted market value as at June 30, 2021:

Rs 2,242,303 thousand; (2020: Rs 2,131,735 thousand) 2,837,424 2,537,432

Unquoted

Attock Information Technology Services (Pvt) Limited (AITSL)

450,000 (2020: 450,000) fully paid

ordinary shares of Rs 10 each 40,742 35,088

13,337,592 10,969,009

All associated companies are incorporated in Pakistan. All associated companies have share capital

consisting solely of ordinary shares, which are held directly by the Group. Although the Group has

less than 20 percent shareholding in APL and AITSL, these have been treated as associates since the

Group has representation on their Board of Directors.

17.2 No investment was made in subsidiary and associated companies during the year.

212 PAKISTAN OILFIELDS LIMITED