Page 216 - Pakistan Oilfields Limited - Annual Report 2021

P. 216

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

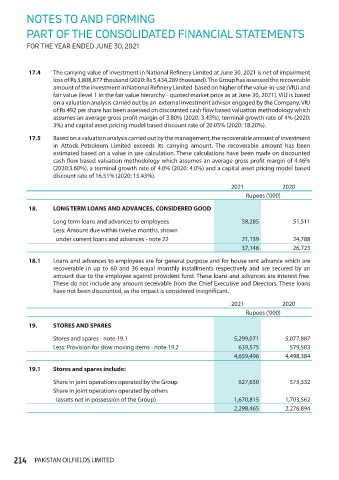

17.4 The carrying value of investment in National Refinery Limited at June 30, 2021 is net of impairment

loss of Rs 3,808,877 thousand (2020: Rs 5,434,289 thousand). The Group has assessed the recoverable

amount of the investment in National Refinery Limited based on higher of the value-in-use (VIU) and

fair value (level 1 in the fair value hierarchy - quoted market price as at June 30, 2021). VIU is based

on a valuation analysis carried out by an external investment advisor engaged by the Company. VIU

of Rs 492 per share has been assessed on discounted cash flow based valuation methodology which

assumes an average gross profit margin of 3.80% (2020: 3.43%), terminal growth rate of 4% (2020:

3%) and capital asset pricing model based discount rate of 20.05% (2020: 18.20%).

17.5 Based on a valuation analysis carried out by the management, the recoverable amount of investment

in Attock Petroleum Limited exceeds its carrying amount. The recoverable amount has been

estimated based on a value in use calculation. These calculations have been made on discounted

cash flow based valuation methodology which assumes an average gross profit margin of 4.46%

(2020:3.60%), a terminal growth rate of 4.0% (2020: 4.0%) and a capital asset pricing model based

discount rate of 16.51% (2020: 15.43%).

2021 2020

Rupees ('000)

18. LONG TERM LOANS AND ADVANCES, CONSIDERED GOOD

Long term loans and advances to employees 58,285 51,511

Less: Amount due within twelve months, shown

under current loans and advances - note 22 21,139 24,788

37,146 26,723

18.1 Loans and advances to employees are for general purpose and for house rent advance which are

recoverable in up to 60 and 36 equal monthly installments respectively and are secured by an

amount due to the employee against provident fund. These loans and advances are interest free.

These do not include any amount receivable from the Chief Executive and Directors. These loans

have not been discounted, as the impact is considered insignificant.

2021 2020

Rupees ('000)

19. STORES AND SPARES

Stores and spares - note 19.1 5,299,071 5,077,887

Less: Provision for slow moving items - note 19.2 639,575 579,503

4,659,496 4,498,384

19.1 Stores and spares include:

Share in joint operations operated by the Group 627,650 573,332

Share in joint operations operated by others

(assets not in possession of the Group) 1,670,815 1,703,562

2,298,465 2,276,894

214 PAKISTAN OILFIELDS LIMITED