Page 233 - Pakistan Oilfields Limited - Annual Report 2021

P. 233

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

Consistent with others in the industry, the Group monitors capital on the basis of the gearing ratio.

The gearing ratio of the Group has always been low and the Group has mostly financed its projects

and business expansions through equity financing. Further, the Group is not subject to externally

imposed capital requirements.

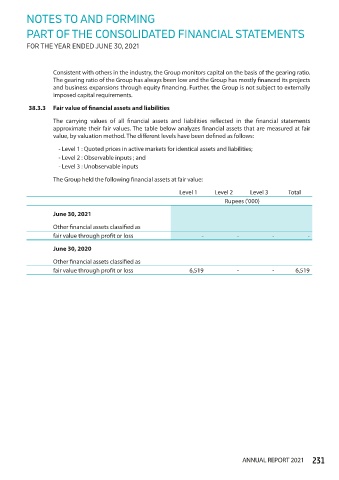

38.3.3 Fair value of financial assets and liabilities

The carrying values of all financial assets and liabilities reflected in the financial statements

approximate their fair values. The table below analyzes financial assets that are measured at fair

value, by valuation method. The different levels have been defined as follows:

- Level 1 : Quoted prices in active markets for identical assets and liabilities;

- Level 2 : Observable inputs ; and

- Level 3 : Unobservable inputs

The Group held the following financial assets at fair value:

Level 1 Level 2 Level 3 Total

Rupees ('000)

June 30, 2021

Other financial assets classified as

fair value through profit or loss - - - -

June 30, 2020

Other financial assets classified as

fair value through profit or loss 6,519 - - 6,519

ANNUAL REPORT 2021 231