Page 235 - Pakistan Oilfields Limited - Annual Report 2021

P. 235

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

2021 2020

Rupees ('000)

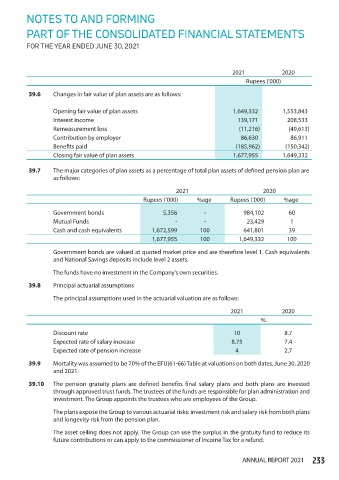

39.6 Changes in fair value of plan assets are as follows:

Opening fair value of plan assets 1,649,332 1,553,843

Interest income 139,171 208,533

Remeasurement loss (11,216) (49,613)

Contribution by employer 86,630 86,911

Benefits paid (185,962) (150,342)

Closing fair value of plan assets 1,677,955 1,649,332

39.7 The major categories of plan assets as a percentage of total plan assets of defined pension plan are

as follows:

2021 2020

Rupees ('000) %age Rupees ('000) %age

Government bonds 5,356 - 984,102 60

Mutual Funds - - 23,429 1

Cash and cash equivalents 1,672,599 100 641,801 39

1,677,955 100 1,649,332 100

Government bonds are valued at quoted market price and are therefore level 1. Cash equivalents

and National Savings deposits include level 2 assets.

The funds have no investment in the Company’s own securities.

39.8 Principal actuarial assumptions

The principal assumptions used in the actuarial valuation are as follows:

2021 2020

%

Discount rate 10 8.7

Expected rate of salary increase 8.75 7.4

Expected rate of pension increase 4 2.7

39.9 Mortality was assumed to be 70% of the EFU(61-66) Table at valuations on both dates, June 30, 2020

and 2021.

39.10 The pension gratuity plans are defined benefits final salary plans and both plans are invested

through approved trust funds. The trustees of the funds are responsible for plan administration and

investment. The Group appoints the trustees who are employees of the Group.

The plans expose the Group to various actuarial risks: investment risk and salary risk from both plans

and longevity risk from the pension plan.

The asset ceiling does not apply. The Group can use the surplus in the gratuity fund to reduce its

future contributions or can apply to the commissioner of Income Tax for a refund.

ANNUAL REPORT 2021 233