Page 236 - Pakistan Oilfields Limited - Annual Report 2021

P. 236

NOTES TO AND FORMING

PART OF THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE YEAR ENDED JUNE 30, 2021

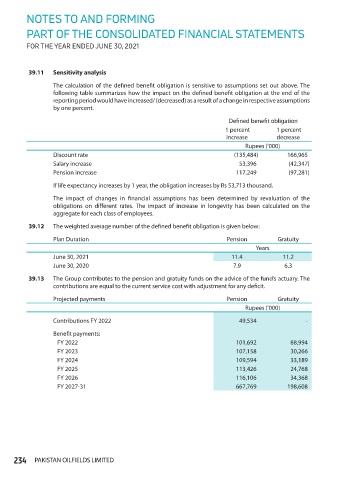

39.11 Sensitivity analysis

The calculation of the defined benefit obligation is sensitive to assumptions set out above. The

following table summarizes how the impact on the defined benefit obligation at the end of the

reporting period would have increased/ (decreased) as a result of a change in respective assumptions

by one percent.

Defined benefit obligation

1 percent 1 percent

increase decrease

Rupees ('000)

Discount rate (135,484) 166,965

Salary increase 53,396 (42,347)

Pension increase 117,249 (97,281)

If life expectancy increases by 1 year, the obligation increases by Rs 53,713 thousand.

The impact of changes in financial assumptions has been determined by revaluation of the

obligations on different rates. The impact of increase in longevity has been calculated on the

aggregate for each class of employees.

39.12 The weighted average number of the defined benefit obligation is given below:

Plan Duration Pension Gratuity

Years

June 30, 2021 11.4 11.2

June 30, 2020 7.9 6.3

39.13 The Group contributes to the pension and gratuity funds on the advice of the fund’s actuary. The

contributions are equal to the current service cost with adjustment for any deficit.

Projected payments Pension Gratuity

Rupees ('000)

Contributions FY 2022 49,534 -

Benefit payments:

FY 2022 101,692 88,994

FY 2023 107,158 30,266

FY 2024 109,594 33,189

FY 2025 113,426 24,768

FY 2026 116,106 34,368

FY 2027-31 667,769 198,608

234 PAKISTAN OILFIELDS LIMITED